All Categories

Featured

Table of Contents

Life insurance aids guarantee that the economic debt you owe towards your home can be paid if something occurs to you. It makes sense to have a plan in location making sure that your household will be able to keep their home no issue what exists ahead.

Sometimes, a combination of insurance coverage types may provide more advantages than a single product service, far better shielding your home in the event that you pass away all of a sudden. The equilibrium owed on your mortgage would always be covered by the combination of one or multiple life insurance policy policies. death insurance on a mortgage. Using life insurance for home mortgage protection can ease the risk of somebody being entrusted to an unrestrainable financial problem

Personalizing your insurance coverage can supply temporary security when your mortgage quantity is highest possible and lasting protection to cover the entire duration of the home loan. The combination strategy can function within your budget, provides versatility and can be created to cover all home loan settlements. There are different methods to make use of life insurance policy to help cover your mortgage, whether with a mix of plans or a solitary plan tailored to your needs.

This plan lasts for the full term of your home mortgage (thirty years). In case of your passing, your family can make use of the fatality advantage to either settle the home loan or make ongoing home mortgage settlements. You acquire an entire life insurance coverage plan to give long-term protection that fits your economic situation.

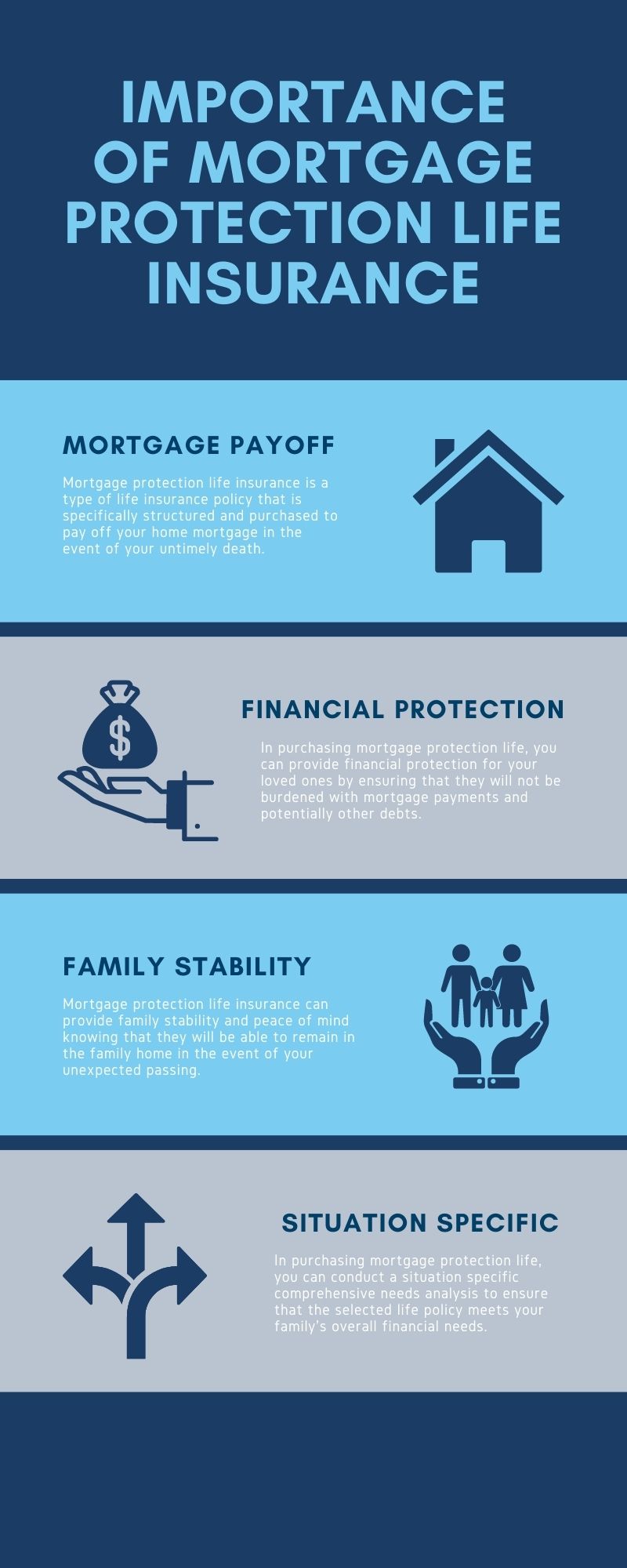

When it concerns protecting your loved ones and making sure the monetary security of your home, understanding mortgage life insurance policy is necessary - mortgage life insurance. Mortgage life insurance is a customized kind of coverage designed to pay back home mortgage debts and linked expenses in the occasion of the customer's fatality. Let's check out the types of home loan life insurance policy readily available and the benefits they use

As home loan repayments are made, the fatality benefit decreases to correspond with the new amortized home mortgage balance impressive. Reducing term insurance policy guarantees that the payout lines up with the continuing to be mortgage financial debt.

Mortgage Insurance Do I Need It

Unlike reducing term insurance coverage, the size of the policy does not decrease in time. The plan provides a set death advantage that stays the very same throughout the term, regardless of the superior mortgage balance. This type of insurance policy is appropriate for customers that have interest-only mortgages and desire to ensure the complete mortgage quantity is covered in the occasion of their death.

When it concerns the destiny of your mortgage after your passing, a number of elements enter play. State and federal regulations play a significant role in determining what occurs to the house and the mortgage when the proprietor passes away. The owner's actions, such as standard estate preparation, can likewise affect the result.

These legislations determine the process and options available to the heirs and beneficiaries. It is essential to understand the particular laws in your territory to browse the circumstance successfully. If you have called an heir for your home in your will, that person usually does not have to take control of your home mortgage, given they are not co-borrowers or co-signers on the financing.

Mortgage Insurance Quote

The choice eventually resides the heir.It's crucial to think about the financial effects for your heirs and recipients. If the assumed beneficiary stops working to make home loan repayments, the lending institution keeps the right to foreclose. It may be required to make sure that the heir can manage not just the home mortgage settlements however also the recurring expenses such as real estate tax, house owners insurance coverage, and upkeep.

In a lot of circumstances, a joint consumer is likewise a joint owner and will certainly come to be the sole proprietor of the property (life insurance on house). This suggests they will certainly think both the possession and the home loan responsibilities. It is essential to note that unless somebody is a co-signer or a co-borrower on the car loan, nobody is legitimately bound to proceed settling the home loan after the customer's death

If nobody thinks the home loan, the mortgage servicer might initiate repossession procedures. Understanding the state and government legislations, the effect on beneficiaries and beneficiaries, and the duties of co-borrowers is critical when it concerns navigating the intricate world of home loans after the fatality of the customer. Looking for legal advice and taking into consideration estate preparation alternatives can assist guarantee a smoother change and shield the passions of all parties entailed.

Mortgage Protection Jobs

In this section, we will certainly discover the subjects of inheritance and home mortgage transfer, reverse home mortgages after fatality, and the role of the surviving spouse. When it comes to acquiring a home with an exceptional home mortgage, numerous aspects enter play. If your will names an heir to your home that is not a co-borrower or co-signer on the lending, they usually will not need to take over the home mortgage.

In instances where there is no will or the beneficiary is not named in the will, the obligation drops to the administrator of the estate. The administrator ought to continue making home mortgage payments using funds from the estate while the home's destiny is being figured out. If the estate does not have sufficient funds or assets, it might need to be sold off to pay off the home loan, which can develop difficulties for the beneficiaries.

When one debtor on a joint mortgage passes away, the making it through partner generally ends up being completely liable for the home mortgage. A joint borrower is also a joint owner, which indicates the enduring partner comes to be the single proprietor of the building. If the home loan was requested with a co-borrower or co-signer, the other event is lawfully obliged to proceed making lending repayments.

It is important for the surviving spouse to interact with the lending institution, understand their rights and responsibilities, and discover available alternatives to guarantee the smooth extension of the mortgage or make required setups if required. Comprehending what takes place to a home mortgage after the fatality of the homeowner is critical for both the successors and the enduring spouse.

, home loan defense insurance coverage (MPI) can offer important insurance coverage. Allow's discover the coverage and advantages of home mortgage protection insurance, as well as vital factors to consider for enrollment.

In the event of your death, the death advantage is paid directly to the home loan lending institution, making certain that the exceptional financing balance is covered. This permits your family members to stay in the home without the added stress and anxiety of prospective financial challenge. One of the benefits of home mortgage protection insurance is that it can be a choice for individuals with serious health problems that might not receive conventional term life insurance policy.

Bank Mortgage Insurance Vs Life Insurance

Enrolling in home loan security insurance policy requires mindful factor to consider. To acquire mortgage defense insurance policy, commonly, you require to enlist within a few years of shutting on your home.

By comprehending the coverage and advantages of mortgage protection insurance coverage, as well as meticulously assessing your options, you can make informed decisions to protect your household's financial wellness even in your lack. When it comes to managing mortgages in Canada after the death of a homeowner, there specify policies and legislations that enter into play.

In Canada, if the dead is the single proprietor of the home, it comes to be an asset that the Estate Trustee called in the person's Will have to handle (insurance mortgage). The Estate Trustee will need to prepare the home up for sale and use the earnings to repay the remaining home loan. This is necessary for a discharge of the homeowner's funding agreement to be signed up

Latest Posts

Will Life Insurance Pay For Funerals

United Home Life Final Expense

Burial Insurance In Louisiana