All Categories

Featured

Table of Contents

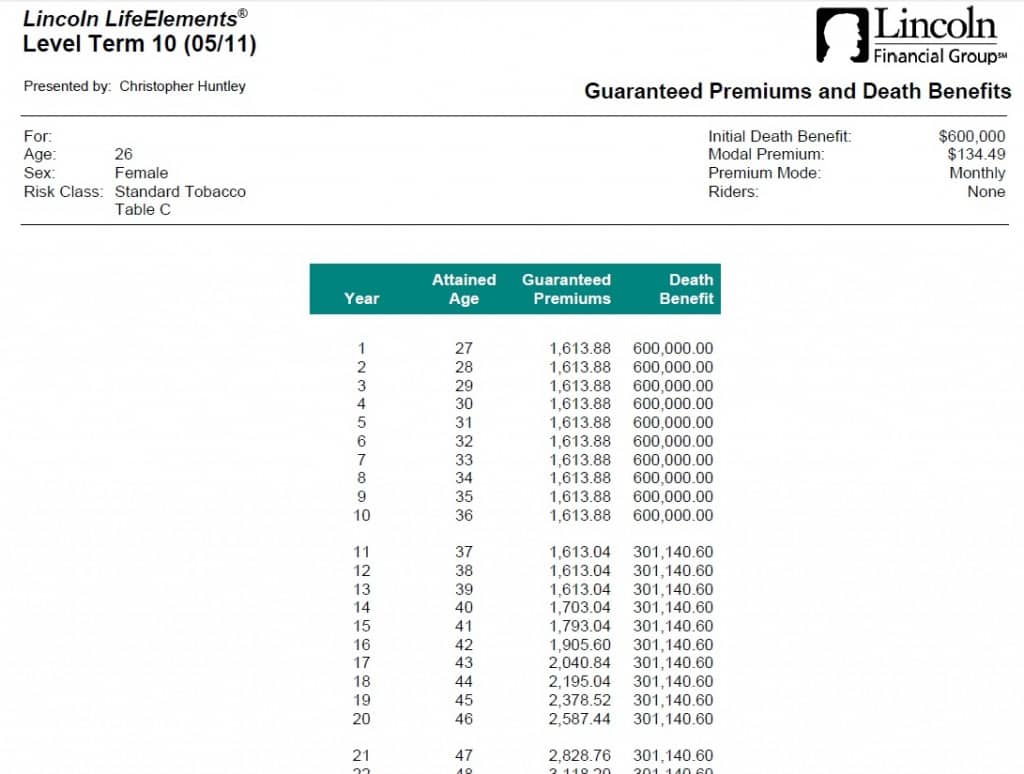

A degree term life insurance policy policy can give you peace of mind that individuals that rely on you will certainly have a survivor benefit throughout the years that you are intending to support them. It's a means to aid care for them in the future, today. A level term life insurance policy (in some cases called level premium term life insurance coverage) plan provides coverage for a set number of years (e.g., 10 or two decades) while maintaining the premium payments the same throughout of the policy.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. final expense life insurance brokers. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

With level term insurance policy, the expense of the insurance coverage will certainly stay the exact same (or possibly lower if dividends are paid) over the regard to your policy, typically 10 or twenty years. Unlike long-term life insurance policy, which never expires as long as you pay costs, a level term life insurance policy plan will end at some time in the future, commonly at the end of the period of your level term.

The Essentials: What is Level Term Life Insurance Policy?

Because of this, several individuals utilize irreversible insurance policy as a stable economic preparation tool that can serve many demands. You might have the ability to convert some, or all, of your term insurance policy during a set duration, normally the initial 10 years of your plan, without requiring to re-qualify for insurance coverage even if your health has actually changed.

As it does, you may desire to include to your insurance protection in the future - What is a level term life insurance policy. As this happens, you might desire to eventually minimize your fatality advantage or take into consideration transforming your term insurance coverage to a long-term policy.

As long as you pay your costs, you can relax easy understanding that your liked ones will certainly receive a death advantage if you die during the term. Numerous term policies allow you the capacity to transform to irreversible insurance policy without having to take an additional wellness test. This can permit you to make use of the fringe benefits of an irreversible policy.

Degree term life insurance policy is among the most convenient courses into life insurance coverage, we'll talk about the advantages and disadvantages to ensure that you can pick a strategy to fit your demands. Degree term life insurance is one of the most usual and basic type of term life. When you're looking for short-term life insurance plans, degree term life insurance is one route that you can go.

You'll fill up out an application that consists of basic individual info such as your name, age, and so on as well as a more comprehensive questionnaire about your clinical history.

The short response is no., for example, allow you have the convenience of death advantages and can build up cash value over time, implying you'll have a lot more control over your advantages while you're alive.

What Exactly is Term Life Insurance Level Term?

Motorcyclists are optional arrangements added to your plan that can provide you additional benefits and protections. Anything can occur over the training course of your life insurance coverage term, and you want to be ready for anything.

There are instances where these advantages are constructed right into your plan, yet they can additionally be offered as a different enhancement that calls for added settlement.

Latest Posts

Will Life Insurance Pay For Funerals

United Home Life Final Expense

Burial Insurance In Louisiana