All Categories

Featured

Table of Contents

- – What Are the Terms in Voluntary Term Life Insu...

- – What is 30-year Level Term Life Insurance and ...

- – What Does Term Life Insurance With Level Prem...

- – The Benefits of Choosing 30-year Level Term L...

- – What is Term Life Insurance For Spouse? A Si...

- – What is the Coverage of Level Term Life Insu...

If George is diagnosed with a terminal illness throughout the initial policy term, he probably will not be eligible to restore the policy when it ends. Some plans supply ensured re-insurability (without evidence of insurability), but such functions come with a greater price. There are numerous kinds of term life insurance.

The majority of term life insurance coverage has a degree costs, and it's the type we've been referring to in most of this post.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - affordable life insurance for young families from agents. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

Term life insurance policy is eye-catching to youths with kids. Moms and dads can acquire significant protection for an affordable, and if the insured dies while the policy is in effect, the family can depend on the fatality advantage to change lost income. These plans are additionally appropriate for people with expanding family members.

What Are the Terms in Voluntary Term Life Insurance?

Term life plans are suitable for individuals who desire substantial protection at a low cost. People that have entire life insurance policy pay extra in costs for much less insurance coverage yet have the security of understanding they are safeguarded for life.

The conversion motorcyclist need to allow you to convert to any kind of long-term policy the insurance coverage business provides without constraints. The primary features of the motorcyclist are preserving the initial health and wellness ranking of the term policy upon conversion (even if you later on have health and wellness problems or come to be uninsurable) and determining when and exactly how much of the protection to convert.

Of course, total costs will certainly enhance significantly since whole life insurance is extra expensive than term life insurance policy. The advantage is the assured authorization without a medical examination. Clinical problems that establish throughout the term life period can not create premiums to be raised. The firm might call for limited or full underwriting if you desire to include additional cyclists to the new plan, such as a long-lasting care motorcyclist.

What is 30-year Level Term Life Insurance and Why Does It Matter?

Whole life insurance policy comes with substantially higher monthly premiums. It is indicated to supply protection for as lengthy as you live.

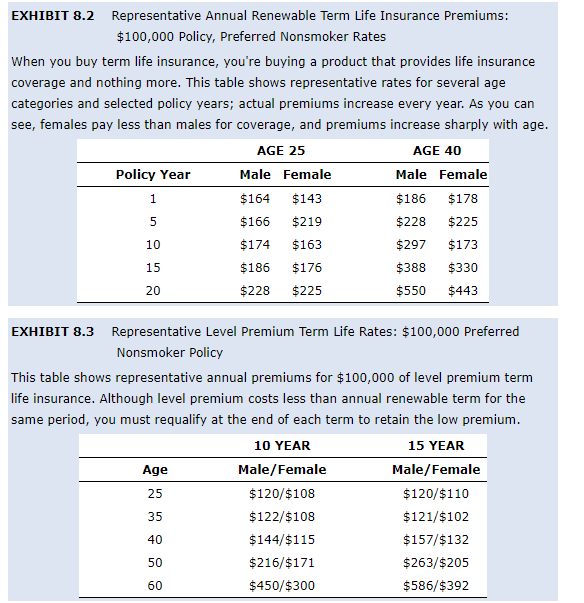

Insurance policy firms established a maximum age restriction for term life insurance plans. The costs additionally increases with age, so a person aged 60 or 70 will certainly pay considerably more than a person years more youthful.

Term life is somewhat comparable to cars and truck insurance. It's statistically not likely that you'll require it, and the premiums are cash down the tubes if you don't. If the worst takes place, your family members will get the advantages.

What Does Term Life Insurance With Level Premiums Mean for You?

Essentially, there are 2 kinds of life insurance policy plans - either term or irreversible strategies or some mix of both. Life insurance providers provide different types of term strategies and typical life policies along with "passion delicate" products which have actually become much more prevalent since the 1980's.

Term insurance policy gives security for a specified time period. This period can be as short as one year or provide coverage for a specific variety of years such as 5, 10, 20 years or to a specified age such as 80 or in many cases up to the earliest age in the life insurance death tables.

The Benefits of Choosing 30-year Level Term Life Insurance

Currently term insurance policy rates are really affordable and amongst the most affordable traditionally experienced. It needs to be noted that it is an extensively held idea that term insurance coverage is the least pricey pure life insurance policy coverage available. One needs to examine the policy terms very carefully to determine which term life alternatives appropriate to fulfill your specific conditions.

With each brand-new term the premium is boosted. The right to restore the policy without evidence of insurability is a crucial advantage to you. Otherwise, the risk you take is that your health might wear away and you may be unable to obtain a policy at the same prices or even in any way, leaving you and your recipients without insurance coverage.

The length of the conversion period will differ depending on the type of term policy purchased. The costs rate you pay on conversion is generally based on your "existing attained age", which is your age on the conversion day.

Under a degree term plan the face quantity of the plan stays the very same for the whole period. With decreasing term the face amount reduces over the period. The premium remains the same every year. Typically such plans are sold as home loan protection with the amount of insurance coverage lowering as the balance of the home loan reduces.

Traditionally, insurers have not had the right to alter premiums after the plan is offered. Because such policies might continue for many years, insurance companies need to make use of traditional death, passion and expense price quotes in the costs estimation. Flexible costs insurance coverage, however, enables insurance providers to offer insurance at lower "present" premiums based upon less conservative presumptions with the right to change these costs in the future.

What is Term Life Insurance For Spouse? A Simple Breakdown

While term insurance is designed to supply protection for a specified time period, long-term insurance coverage is developed to give coverage for your entire lifetime. To maintain the costs rate level, the premium at the younger ages exceeds the actual price of defense. This added costs develops a book (cash worth) which helps pay for the policy in later years as the expense of protection increases above the premium.

The insurance business invests the excess premium dollars This type of policy, which is sometimes called cash money value life insurance coverage, produces a cost savings element. Money worths are essential to an irreversible life insurance policy.

Occasionally, there is no relationship between the dimension of the cash worth and the premiums paid. It is the cash worth of the policy that can be accessed while the policyholder lives. The Commissioners 1980 Criterion Ordinary Death Table (CSO) is the current table made use of in computing minimum nonforfeiture values and policy gets for ordinary life insurance plans.

What is the Coverage of Level Term Life Insurance?

Numerous irreversible policies will contain stipulations, which specify these tax obligation needs. Typical entire life plans are based upon long-lasting estimates of expenditure, rate of interest and mortality.

Table of Contents

- – What Are the Terms in Voluntary Term Life Insu...

- – What is 30-year Level Term Life Insurance and ...

- – What Does Term Life Insurance With Level Prem...

- – The Benefits of Choosing 30-year Level Term L...

- – What is Term Life Insurance For Spouse? A Si...

- – What is the Coverage of Level Term Life Insu...

Latest Posts

Will Life Insurance Pay For Funerals

United Home Life Final Expense

Burial Insurance In Louisiana

More

Latest Posts

Will Life Insurance Pay For Funerals

United Home Life Final Expense

Burial Insurance In Louisiana